WSDOT Secretary Wants Mandatory GPS Tracking for a Road User Fee » Publications » Washington Policy Center

If the Washington State Department of Transportation (WSDOT) has its way, the state will mandate GPS tracking to not only charge drivers for every mile driven, but to adjust the fee based on when, where and why you take the ride .

During the Washington State Transportation Commission’s (WSTC) virtual meeting on July 15, WSDOT Secretary Roger Millar described how he would introduce a road user charge (RUC). As it turns out, Millar’s vision for an RUC fundamentally contradicts and undermines the commission’s recommendations.

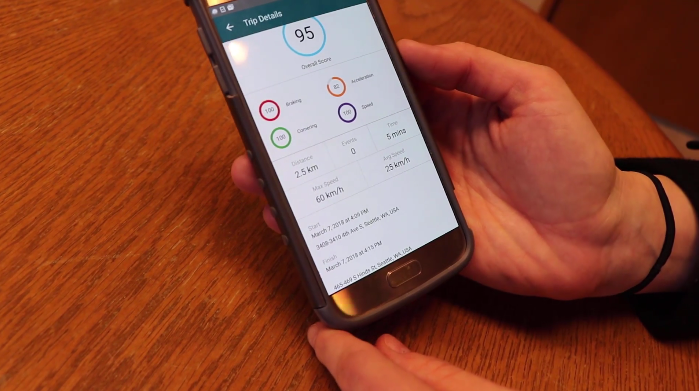

The WSTC has led efforts to study, test and report to legislators on the feasibility of a Washington State tolling system. According to the agency, the RUC will act as a substitute for the gas tax, charging motorists for every kilometer they drive rather than for every gallon of gas they buy at the pump.

However, some officials and transit activists would like the RUC to serve as a general mileage tax that can be diverted from roads to subsidize transit, bicycle and pedestrian projects. To further complicate and political matters, some officials, like Minister Millar, advocate that the RUC should be stratified with different functions – not just charging people per kilometer driven, but making it more expensive to drive during rush hours or different fares charge on different roads.

These proposals intentionally make the RUC more onerous on drivers and allow politicians to use the money for what they think is best.

Also, this approach dilutes the user-pays/user-benefit principle that an ideal RUC should embody. The user-pays/user-benefit principle recognizes that people should pay directly to use the highways and receive a direct benefit in return. In fact, this is how Washington state’s current gas tax works (although many other states don’t) because it’s constitutionally protected by the state’s 18th Amendment for highway expenses only. Although the gas tax revenues are not immune from politics (what is funded and when), legally they can only be spent on highway purposes.

If an RUC is to replace the gas tax, it should replicate the characteristics of a gas tax: the money should only be spent on roads and not act as a costly social engineering tool. As technology advances and vehicles use different methods of propulsion, it is necessary to start a conversation about ways to fund and maintain the roads we depend on, regardless of the type of vehicle we drive. Billing per mile is an important part of this discussion.

However, we recognize that government officials can distort and misuse good ideas to further their own ideological ends. Millar’s vision for an RUC is a perfect example of this bias and shows why it is so difficult for the public to confide in politicians with this idea.

At the WSTC meeting, he said that an RUC should be combined with congestion charges, rather than just being a per-mile charge. He added, “When I spoke to the leadership in DC — the House Transportation and Infrastructure Committee and the Senate Environment & Public Works Committee, the chairs and senior members of those committees — they all want road tolls to be collected sooner or later in the USA – and everyone wants to see the road pricing construct include congestion pricing – the ability to vary prices based on geographic location, time of day and purpose of travel.”

Contrary to Millar, the Commission has stated that an RUC should not include congestion charges (see last point on slide below).

The Commission notes that while an RUC “could include pricing for congested corridors”, “this would require the mandatory use of GPS”, which is inconsistent with key priorities. These priorities are choice (being able to choose a non-GPS method of transmitting mileage information) and privacy (not sharing your location while traveling if you don’t want to).

In the Commission’s final report on RUC, one of the key recommendations for legislators is to “legislate on privacy” (p. 70). These include things like ensuring drivers can choose not to use a GPS-enabled device, software requirements that make access to driving data inaccessible to others, and policies that exempt RUC mileage data from publication (applicable law sees this exception does not exist). This recommendation excludes congestion charges, which would require location data.

The commission also recommends that an RUC be protected under the 18th amendment of the state constitution so that the money can only be spent on highway purposes. For more than two years, the Washington Policy Center has emphasized the importance of the 18th Amendment to ensure that any new tax is a usage fee, like the state gas tax is.

We understand that in these unprecedented times, the road toll is probably the last thing on your mind. It’s probably frustrating to read that some public bodies are focused on finding ways to track our travel decisions and behavior while people focus on keeping the lights on at home and in their businesses. That’s why the Washington Policy Center will continue to keep this issue under close watch — especially against the backdrop of what’s likely to be a very contentious legislative session in 2021, when every possible tax could be on the table in the transportation budget debate.

You can follow our work here on our website – and also on our Twitter and Facebook pages:

Twitter: @WAPolicyCenter and @MariyaFrost

Facebook: Washington Policy Center

Comments are closed.